Debt-Free… the NEW American Dream!

In 1928, Herbert Hoover had a presidential campaign slogan, “A chicken in every pot and a car in every garage...” (National Archives Catalog) He won the election by a landslide, but America quickly took a turn for the worse and was found in one of the worst depressions our country has ever experienced. It took a devastating war to bring America back to a healthy economic state. Since that time, the American dream has greatly evolved. It is now depicted as having a huge house with a well-manicured lawn surrounding a beautiful pool. Parked in the driveway are two or more shiny new cars, and possibly a boat or an RV. This new version of the American dream is displayed from early childhood and spans every stage of our lives through every form of media! We see this lifestyle in movies, magazines, and stores as well as on TV and billboards. Today, we even read it on social media and Pinterest. The new American Dream now appears to be MORE and BETTER STUFF... at any cost. We have drifted very far from just wanting a chicken and a simple mode of transportation.

In 1928, Herbert Hoover had a presidential campaign slogan, “A chicken in every pot and a car in every garage...” (National Archives Catalog) He won the election by a landslide, but America quickly took a turn for the worse and was found in one of the worst depressions our country has ever experienced. It took a devastating war to bring America back to a healthy economic state. Since that time, the American dream has greatly evolved. It is now depicted as having a huge house with a well-manicured lawn surrounding a beautiful pool. Parked in the driveway are two or more shiny new cars, and possibly a boat or an RV. This new version of the American dream is displayed from early childhood and spans every stage of our lives through every form of media! We see this lifestyle in movies, magazines, and stores as well as on TV and billboards. Today, we even read it on social media and Pinterest. The new American Dream now appears to be MORE and BETTER STUFF... at any cost. We have drifted very far from just wanting a chicken and a simple mode of transportation.

While some people are striving to reach the New American Dream, others are striving to become debt free. We’re beginning to see an influx of people wanting to pay off travel debt or their credit cards in order to live simply, or just to have a clean slate. But rather than “buying in” to the big new dream and amassing debt, wouldn’t it have been great for everyone to start adult life with ZERO debt and ZERO intention of getting into debt?

We have a great opportunity to set our kids on the path of being debt free, but where do we even begin?

First, it’s important to understand how kids learn!

Kids Learn by Seeing.

Have you heard the saying, “Do what I say, not what I do?” Yeah, me too! But I’m not convinced. Most of us, not just kids, learn by what we see others doing. This is called observational learning, or modeling. This learning method was first cited by psychologist, Albert Bandura (Cognitive Approaches to Learning ). He found that children were more likely to learn a behavior by observing someone else exhibit that behavior. Furthermore, he found that a behavior was more likely to “stick” if it was modeled by someone that the child respected.

"The most important thing parents need to do is lead by example," says Dr. Taliba Foster, a child psychiatrist. "Being frugal is more of a lifestyle, not a lesson. It has to be part of the family lifestyle." (10 Easy Frugal Lessons to Teach Your Kids) When kids see their parents practicing smart money management, a lifestyle is demonstrated.… not just verbalized. After all, “Actions do speak louder than words!”

Kids Learn by Doing.

It’s a well-known fact that kids tend to learn better by doing rather than just reading about a concept or hearing about it. Resource Area for Teaching has found that there is a significant “engagement gap” that needs to be addressed. This gap lies between conventional teaching methods and the depth of comprehension and knowledge. Hands-on learning helps to bridge this gap and prepare students for the 21st-century workplace. University of Portland advocates for project-based learning, where visual, listening, and hands-on approaches are combined to help students retain information.

It’s a well-known fact that kids tend to learn better by doing rather than just reading about a concept or hearing about it. Resource Area for Teaching has found that there is a significant “engagement gap” that needs to be addressed. This gap lies between conventional teaching methods and the depth of comprehension and knowledge. Hands-on learning helps to bridge this gap and prepare students for the 21st-century workplace. University of Portland advocates for project-based learning, where visual, listening, and hands-on approaches are combined to help students retain information.

Activity-based learning is essential to establish fundamentals of money management. For a program that teaches hands-on money management, consider the method used by The Kingdom Code: Make & Manage Money…God’s Way! While in class, students practice counting money, learn introductory accounting terms, determine how to price a service job, and begin keeping a simple ledger. Students are guided step-by-step through the process of starting their own businesses. After learning and employing these basic entrepreneurial skills, students then apply their knowledge in the real marketplace where they gain first-hand monetary experiences. These real-life experiences are priceless teachers of skills that cannot be learned exclusively by reading, observing, or hearing alone. Sometimes kids just have to “do it” before they truly appreciate and understand the fundamentals of money management// how to manage money.

What do kids need to know to begin a debt-free lifestyle?

-

Buying Principles

There is an art to buying. As an adult, you’ve probably put some of these skills to practice without even realizing it! These skills can easily be taught to your children, in order for them to develop a lifestyle of smart money management.

- Resist Impulse Buying – It’s vital that kids know how to use discernment when shopping to avoid emotional appeal in advertising. It’s no secret that companies use very compelling marketing to entice our materialistic nature. As consumers, we have to be smarter than the firestorm of products being thrown at us. As parents, we have the responsibility to practice smart consumerism and impart wisdom. Today.com gives a list of their 10 Commandments for Being a Smart Consumer. “False and deceptive ads can appear anywhere: on trusted websites, in well-known publications, on TV or radio. Don’t assume the publishing or broadcasting company verified the advertising claims.” They suggest doing research before you buy. Doing research before buying can protect you from spending too much money or buying a product that doesn’t match-up to the advertising claims. This smart money management practice can also create an opportunity for delayed gratification.

Children (and adults too) are so accustomed to instant gratification! When shopping, it can be all too easy to see something that you must have and immediately buy the item. We can teach our kids to practice delayed gratification by discussing the pros and cons of buying an item later. It is important for kids to understand why waiting to purchase a product can be wiser than buying it straight away. After a discussion, the conclusion is often reached that the item is not needed and should never be bought at all!

Kids need to learn how to refrain from buying unnecessary items!

Kids need to learn how to resist buying something just because it “feels” like a good idea at the moment.

Kids need to learn to save money for purchasing an item later.

Kids need to practice self-control when tempted by alluring products and commercials. This great skill only comes with lots of practice and awareness!

As parents, we can help in teaching this concept by modeling it for our children. When they see us, as parents, waiting for a particular sale or doing research before buying, they will begin to realize how important it is to resist impulse buying. By resisting impulse buying, children can begin to practice smart money management.

- Compare Prices – What looks like a good deal isn’t always the best bargain. There are creative ways to help children understand the importance of comparing prices and how much can be saved from this simple practice.

Take your kids with you when you go grocery shopping and help them compare prices between brands and quantities. As you make choices, discuss the buying process with your kids. How? Tell them why you chose the one you did. Granted, we mentally make decisions on what to buy as we shop. Try to audibly reason your decision-making with your kids so they can be included in your thought processes and learn personally how to question “to buy or not to buy.” It’s important that they understand how to make these money management decisions!

Take your kids with you when you go grocery shopping and help them compare prices between brands and quantities. As you make choices, discuss the buying process with your kids. How? Tell them why you chose the one you did. Granted, we mentally make decisions on what to buy as we shop. Try to audibly reason your decision-making with your kids so they can be included in your thought processes and learn personally how to question “to buy or not to buy.” It’s important that they understand how to make these money management decisions!

Denise Winston of Bakersfield, Calif., who owns the website MoneyStartHere.com suggests researching different products before making a final purchase. She explains that this practice can teach kids how to plan for purchases and delayed gratification. ( 10 Easy Frugal Lessons to Teach Your Kids)

- Know the difference between NEEDS and WANTS – Having discipline and knowing what are and are not necessities can bring true contentment. The Kingdom Code curriculum emphasizes this concept throughout the entire course. As you know, it is often very difficult to teach kids how to differentiate between needs and wants, because commercials and ads are constantly presenting products as being a necessity! Jenae, from ICanTeachMyChild.com, has a great activity that can help kids learn the difference.

Children often find themselves desiring things that other kids have. They can feel deprived and somehow cheated. This provides an opportunity to “neutralize peer pressure,” as LearnVest.com describes it. They suggest reminding your kids of the things they have that other kids don’t. Andrea Pyros, a writer for LearnVest.com says, “The goal here is to remind your child that everyone gets to be first at something.”

When children know the difference between the things that are needs and wants, they can begin to understand what it means to be content. Also, when children gain perspective on what in life is truly significant, they will cherish the contentment that comes with that knowledge. Children can learn to live within their means when they are young and carry that understanding into adulthood.

If you’re looking for a truly engaging program that teaches kids about these important buying principles, consider The Kingdom Code: Make and Manage Money… God’s Way!

-

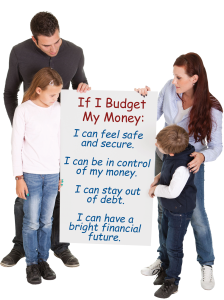

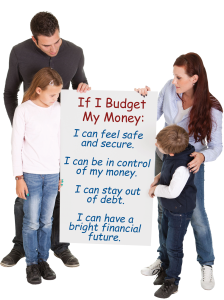

Budgeting

Budgeting is a hard practice, even for adults! But…

Knowing the basic concepts and percentages of saving, giving, and spending can drastically change your money habits.

Experts agree that the earlier kids learn to budget, the better! Teresa Mears, a contributing writer for U.S. News, says there is no such thing as starting too early when it comes to teaching kids about money and budgeting. That’s why The Kingdom Code Team created the JR KCK Budget Kit for kids three and up who are too young to start the program. Check it out!

Experts agree that the earlier kids learn to budget, the better! Teresa Mears, a contributing writer for U.S. News, says there is no such thing as starting too early when it comes to teaching kids about money and budgeting. That’s why The Kingdom Code Team created the JR KCK Budget Kit for kids three and up who are too young to start the program. Check it out!

As many as 40% of millennials still receive financial help from their parents, according to 2015 statistics from a Bank of America report. And a recent Pew Research report found that more than 30% of young people between ages 18 and 34 are living with parents in 2014. (9 Ways Parents Can Teach Young Kids to Budget) These young adults have been coined as “Boomerang Kids” since they once lived on their own, but because of money and other factors, had to move in with parents again. Some of the influx of Boomerang Kids and the financial dependence on parents could be avoided with early instruction of how to budget. Kids need to understand that when money is strategically allocated, sporadic spending can be controlled. Plus, when a budget is in place, kids can see where their money is going. Like anything, the more children utilize a budget, the better they will become at budgeting their money!

Kerry, creator of SelfSufficientKids.com found that her daughter failed to save because she was falling into the trap of instant gratification. Kerry says, “My daughter was falling into the mindset many adults do: satisfying instant gratification overworking to meet larger savings goals.” When children are taught about budgeting and overcoming instant gratification, they are better prepared to meet financial goals as adults.

For budgeting tools for your kids, check out this new, incredible homeschool program or Christian school elective. There’s none other like it!

-

Confidence in Money Management

Money matters tend to be frustrating and complicated, but they don’t have to be. There is a confidence that is gained by putting smart money management into practice from a young age.

A recent poll conducted led by the National Foundation for Credit Counseling (NFCC) found that less than ten percent of people polled felt that they had their finances under control. That is a staggering percentage that we must reconcile. Jesse Campbell from MoneyManagement.org stated that “Very few schools teach basic financial education to young students.” This is very true, so children must learn confidence in money management elsewhere.

When kids are taught about money management at a young age, they are better prepared to make wise and confident money decisions later in life. Adults who set out on a smart money trajectory will find themselves more confident, better consumers, and more content.

If you’re needing more resources on how to teach your kids to manage money, check out this program that takes students step-by-step through a comprehensive money management course.

-

Work Ethic

Young People can know every bit of knowledge on how to manage money, but if they don’t know how to work hard, they will not reap the full benefits of their knowledge.

It can be difficult to teach kids how to work hard and be diligent in a job. Teaching kids a strong work ethic means starting early! Crystal Paine encourages to start early with age-appropriate chores. Once kids are introduced to work, they will have a better grasp of what it takes to get a job done and get it done well. The Center for Work Ethic Development has found that a “work ethic is a predictor of adult success” and implementing a good work ethic in children is integral to adult work ethic. They have also found that work ethic is established by the third grade!

Before kids are old enough to work a real job, it’s important for there to be some payment for work. There are many ways you can organize an “allowance” system. Some parents have required chores for every member of the family that don’t render an allowance. Then, the jobs they might pay someone else to do, they allocate those jobs to their kids for an allowance as payment.

Before kids are old enough to work a real job, it’s important for there to be some payment for work. There are many ways you can organize an “allowance” system. Some parents have required chores for every member of the family that don’t render an allowance. Then, the jobs they might pay someone else to do, they allocate those jobs to their kids for an allowance as payment.

When teaching kids about work ethic, it’s important to have resources that reinforce this concept. The Kingdom Code program teaches kids how to create their very own businesses from the ground up. Nothing teaches a good work ethic like becoming an entrepreneur! In fact, the first eight lessons of The Kingdom Code curriculum are devoted to teaching kids how to establish a business and gain entrepreneurial skills. Through entrepreneurship, children develop a strong work ethic via first-hand experience.

Debt-free living is more than just a one-time decision. It takes a lifetime of smart money choices. Kids can be taught how to make wise money choices by practicing important buying principles, budgeting, practicing managing money when young, and developing a strong work ethic. By combining these 4 debt-free fundamentals learned through hands-on learning and observational learning, kids can be on their way to…

The NEW American Dream… a DEBT-FREE Life!

In 1928, Herbert Hoover had a presidential campaign slogan, “A chicken in every pot and a car in every garage...” (

In 1928, Herbert Hoover had a presidential campaign slogan, “A chicken in every pot and a car in every garage...” (

It’s a well-known fact that kids tend to learn better by doing rather than just reading about a concept or hearing about it. Resource Area for Teaching has found that there is a significant “engagement gap” that needs to be addressed. This gap lies between conventional teaching methods and the depth of comprehension and knowledge. Hands-on learning helps to bridge this gap and prepare students for the 21st-century workplace.

It’s a well-known fact that kids tend to learn better by doing rather than just reading about a concept or hearing about it. Resource Area for Teaching has found that there is a significant “engagement gap” that needs to be addressed. This gap lies between conventional teaching methods and the depth of comprehension and knowledge. Hands-on learning helps to bridge this gap and prepare students for the 21st-century workplace.

Take your kids with you when you go grocery shopping and help them compare prices between brands and quantities. As you make choices, discuss the buying process with your kids. How? Tell them why you chose the one you did. Granted, we mentally make decisions on what to buy as we shop. Try to audibly reason your decision-making with your kids so they can be included in your thought processes and learn personally how to question “to buy or not to buy.” It’s important that they understand how to make these money management decisions!

Take your kids with you when you go grocery shopping and help them compare prices between brands and quantities. As you make choices, discuss the buying process with your kids. How? Tell them why you chose the one you did. Granted, we mentally make decisions on what to buy as we shop. Try to audibly reason your decision-making with your kids so they can be included in your thought processes and learn personally how to question “to buy or not to buy.” It’s important that they understand how to make these money management decisions!

Experts agree that the earlier kids learn to budget, the better!

Experts agree that the earlier kids learn to budget, the better!

Before kids are old enough to work a real job, it’s important for there to be some payment for work. There are many ways you can organize an “allowance” system. Some parents have required chores for every member of the family that don’t render an allowance. Then, the jobs they might pay someone else to do, they allocate those jobs to their kids for an allowance as payment.

Before kids are old enough to work a real job, it’s important for there to be some payment for work. There are many ways you can organize an “allowance” system. Some parents have required chores for every member of the family that don’t render an allowance. Then, the jobs they might pay someone else to do, they allocate those jobs to their kids for an allowance as payment.