Teach Kids About Money - The Importance of Teaching Children How to Make & Manage Money

Want to teach kids about money? We understand! Teaching your children how to make and manage money is very important! We teach our kids many things, and we start early. As soon as they show interest, we teach them to walk. Our kids start their first babbles, and we encourage them to form the words "DaDa," or "MaMa." We buy them books to inspire counting and learning the alphabet. But at what point do we stop our kids from continually asking us for money, while we dole out cash right and left? We need to empower our children with the skills to manage their own money while they are young. Then, we are no longer enablers, but educators who teach kids about money - giving our children valuable "money smart" tools that will benefit them forever!

The importance of teaching your children how to make and manage money is paramount!

As parents, we want life to be better for our kids! We want them to know the value of a dollar, the dangers of debt and credit cards, and the rewards of sticking to a budget. We especially want to prevent our children from making the same financial mistakes that we made. We can accomplish this if we equip them early with the basic financial principles of earning, budgeting, and saving. If they are well prepared to make good financial decisions, hopefully our kids can later avoid costly financial mistakes that could follow them for decades.

Why Teach Kids About Money? Why Teach Kids to Budget?

In a world where people check their bank accounts daily to see how much they have left to spend, there needs to be a change in attitude. Our economy is built on "invisible money" that is easily transferred with the swipe of a card. It's now incredibly easy to spend money! When we use a card, it feels as though one is not losing much because the money is never seen or held. No cash visibly changes from one hand to another. It's important that our kids are taught to manage real money while they are still young, before they begin using debit and credit cards. They must learn that a "swipe" represents a loss of cash, and it's a lot easier to spend money than to save it. They need to understand how to allocate money and be in control.

In a world where people check their bank accounts daily to see how much they have left to spend, there needs to be a change in attitude. Our economy is built on "invisible money" that is easily transferred with the swipe of a card. It's now incredibly easy to spend money! When we use a card, it feels as though one is not losing much because the money is never seen or held. No cash visibly changes from one hand to another. It's important that our kids are taught to manage real money while they are still young, before they begin using debit and credit cards. They must learn that a "swipe" represents a loss of cash, and it's a lot easier to spend money than to save it. They need to understand how to allocate money and be in control.

Following a budget quickly takes money management to a whole new level! Children quickly begin to understand the value of each dollar and gain confidence as they make monetary decisions of where to spend and save their money. The intent of teaching kids good money management skills is to help them circumvent a negative approach to money. The more experience they gain, the faster a good financial attitude evolves.

Why Teach Kids to be Content?

When we teach kids how to budget their own money, they are more likely to be content with what they have. Our culture encourages a materialistic attitude and prioritizes "new" over the old and outdated. There is a reason a new and "better" phone is released every year. The electronics industry knows we are drawn to something if we are told it is somehow improved... rendering our current device as "not good enough." There is a solution to this epidemic, but it takes some effort from parents, churches, and educators. We must talk to our children about what it means to be content. So, where do we start? As Christians, we learn contentment from The Word.

"... Whoever loves money never has enough: ... This too is meaningless. ..." - Ecclesiastes 5:10

To live Biblically, we must learn to be content with what God has given us. And as parents, it's important that we impart this to our children through role modeling.

Part of being content is knowing how to live within your means. Plenty of young people, and older too, have lost the ability to spend only money they actually possess. Social media and the current culture have contributed to the obsession of having a Pinterest board home or something straight off HGTV. Young families especially, are going into debt trying to "keep-up with the Joneses." The earlier we teach our kids to live content lifestyles, the sooner our children will be empowered to live debt-free futures.

Sometimes kids need a reality check because they don't understand how much money it takes to live a particular lifestyle. This can cause them to grow up living beyond their means. There are many online resources that help kids understand financial principles. There is an online educational resource that actually gives kids a "Reality Check". Here they can fill out a questionnaire on how they envision living as a young adult. Some of the questions include: What will your mode of transportation be? Where will you live? How much in student loan debt will you have? Then, the program calculates the results to determine how much money is required and what kind of job is needed to support that lifestyle. The program also gives the type of education needed to supply the money needed. This is a great resource for kids that don't understand how far – or how little – a dollar will stretch.

Why Are Parents Best Equipped to Teach their Kids about Money?

"... God tells us to train up our children, and when they are old, they will not depart from it. ..." - Proverbs 22:6

Research shows that kids learn best from those they respect. This research also points out that kids learn through what they call "modeling," or you might call it, "Monkey see, monkey do." Kids will mimic what they see, especially by those they trust and respect and are in contact with the most. Tehlio Credit Union encourages parents to "teach by example" and also says that "experience is the best teacher." As parents, we have heard it said, "Actions speak louder than words." This is true, but it never hurts to reinforce our actions with some explanation and "hands-on" experiences.

A good example of this is when you are doing your grocery shopping. So many times, we are tempted to just leave the kids at home because it is easier, but by doing that, we miss out on a great teaching opportunity. As you shop with your children, explain the reasoning behind why you select certain brands over others. For you, it may be just a taste preference, but it could also be a price per ounce difference that makes your grocery bill lower. Explain these differences as you shop. You can even make a game of it! As you walk the aisles, encourage children to look above and below eye level. Grocery stores will place the more expensive items at eye level, hoping you will spend more money. These small concepts that you teach your kids will help them develop good money management skills and will prepare them for debt-free living.

You can try to set a good example for your kids to live by, but as parents, we don't always do things perfectly, especially when it comes to money management. Our kids can also learn from our mistakes. Yes, our mistakes can become valuable teaching moments for our children! We can often teach our kids how to manage money by discussing and examining our own monetary mistakes. It can be hard to admit when we have dropped the ball, but so much humility and wisdom can be learned from our mistakes, both by our kids and us.

Why Now?

A lot of universities are making money management courses mandatory for incoming freshman, so why should your child learn money management skills now? That's a good question. For some of you, the reason may enter your mind immediately. One homeschooling Co-Op teacher recalls, "For me, it certainly does! Some of the first REALLY big money mistakes I made happened when I signed-up for my first student loans. The next one happened soon after that when I decided to take a work study job instead of pursuing another part-time job to help with college expenses."

It's important as parents that we provide wisdom now that will be a foundation for our children to build upon. So many money management principles can be taught at a very early age and then become great foundational building blocks for more complex money management concepts.

Delayed gratification is a perfect example! If you teach kids about money, so they can learn to save for something they really want ... and wait until they have the money to buy the item with their own money, then a great financial principle has been mastered. Along with teaching our kids skills to help them avoid money management mistakes, we can also encourage them to build up savings accounts that will benefit them as adults. Cornerstone On Demand says it best in this quote on kids' money management "Learning to manage your money now makes it easier to do the things that you want to in the future."

Debt free is the new American dream! And we parents can give our children the vision to see that a debt-free lifestyle is possible.

Most of us have heard or read the verse from 1 Timothy 6:10: "... For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows. ...".

It's vital that our kids understand the difference between being good stewards of money and letting money become a god. In today's society, money is often the only measuring stick for success or the true value of a person ... when you teach kids about money God's way ... you enable them to understand and develop value in a better way!

Matthew 6:24 NIV, says: "... No one can serve two masters. Either you will hate the one and love the other, or you will be devoted to the one and despise the other. You cannot serve both God and money. ..."

We must point our kids toward wisdom that comes from the Word of God.

In addition, the sooner we teach our kids the principles of money management, they can begin to make mistakes while there isn't too much at stake. Lacey Horton, in her blog: 6 Keys to Building Confidence in Your Kids, says we should Allow Mistakes and Failures to occur at a young age, so we can then teach our children how failure "can be a learning opportunity and chance to find courage and confidence." Her belief is that we should "redefine failure". In The Kingdom Code program text, Thomas Edison is quoted, "I have not failed, I've just found 10,000 ways that won't work." What a positive attitude to have when something goes wrong! As adults, we understand that mistakes and failures are inevitable. The true test comes in how we recover from those mistakes and redeem the situation. This is best learned at a young age, when one doesn't have a spouse and/or family that is dependent upon you. In time, a confidence is forged from taking the time to develop good habits in money management.

Why Teach our Kids to Give?

One of the many principles taught from The Bible is giving. Proverbs 11:25 declares: "... A generous person will prosper; whoever refreshes others will be refreshed. ..."

2 Corinthians 9:7 declares: "... Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver. ...".

This is another principle that our children can learn by observing the habits of parents, but we can also teach them to give by encouraging giving with their very own money. When we teach our kids how to budget money, we can instruct them on how to designate a percentage of the money they make to give gifts to others. Gifts mean so much more when they are purchased with personal money that has been earned from hard work.

We can also instill the principle of giving in our kids by teaching them to tithe. 2 Chronicles 31:4-5 declares: "... He ordered the people living in Jerusalem to give the portion due the priests and Levites so they could devote themselves to the Law of the LORD. 5 As soon as the order went out, the Israelites generously gave the firstfruits of their grain, new wine, olive oil and honey and all that the fields produced. They brought a great amount, a tithe of everything. ...".

When parents can teach kids how to manage money with giving and tithing in mind, kids will learn a healthy, Biblical view of money management.

Give the Gift of Biblical Money Management

As a parent, it's hard to know what to buy your kids for birthdays or Christmas. We want to get them something that they will enjoy for a long time, but also something that isn't completely un-educational and materialistic.

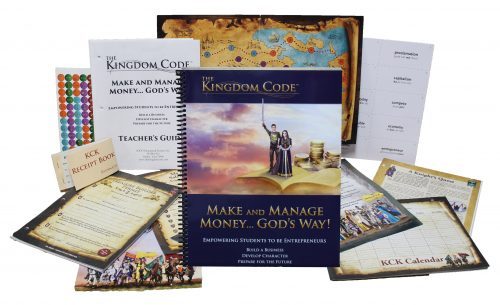

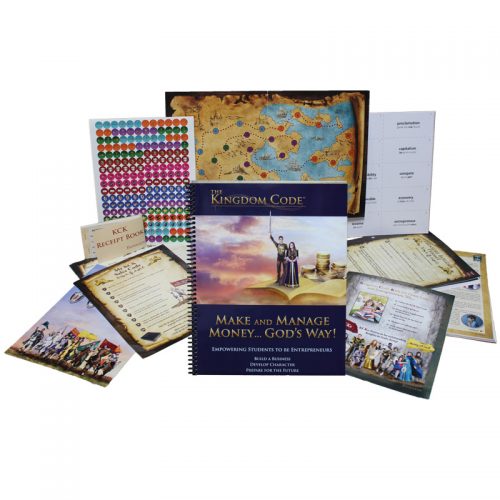

Buying something that will teach your children a lifestyle of managing money well is an awesome choice. Something that will teach them budgeting so they can avoid debt, such as student loans, is a great option! We don't often think along these lines when buying gifts, but The Kingdom Code curriculum is a perfect solution for parents or grandparents who want to give a gift that will last a lifetime.

Jimmie Byler, the creator of The Kingdom Code – curriculum designed to teach kids about money, was inspired by her grandchildren to write her unique program. She wanted them to learn a lifestyle of financial awareness while they were young that would empower them to be money-smart adults. With The Kingdom Code, students will learn how to build a service business from someone who has actually built and managed successful businesses. This important program involves practical applications that have been tested over time. In addition, this course teaches from a Biblical perspective. There is just no other kids' money management program like it!

Invest in your Child's Financial Future! Buy and teach The Kingdom Code: Make and Manage Money... God's Way!

In a world where people check their bank accounts daily to see how much they have left to spend, there needs to be a change in attitude. Our economy is built on "invisible money" that is easily transferred with the swipe of a card. It's now incredibly easy to spend money! When we use a card, it feels as though one is not losing much because the money is never seen or held. No cash visibly changes from one hand to another. It's important that our kids are taught to manage real money while they are still young, before they begin using debit and credit cards. They must learn that a "swipe" represents a loss of cash, and it's a lot easier to spend money than to save it. They need to understand how to allocate money and be in control.

In a world where people check their bank accounts daily to see how much they have left to spend, there needs to be a change in attitude. Our economy is built on "invisible money" that is easily transferred with the swipe of a card. It's now incredibly easy to spend money! When we use a card, it feels as though one is not losing much because the money is never seen or held. No cash visibly changes from one hand to another. It's important that our kids are taught to manage real money while they are still young, before they begin using debit and credit cards. They must learn that a "swipe" represents a loss of cash, and it's a lot easier to spend money than to save it. They need to understand how to allocate money and be in control.